In an ever-changing world, securing your future and protecting your loved ones has become more important than ever. USA Max Life Insurance understands the significance of safeguarding your financial well-being. With their comprehensive range of insurance policies, they offer simple yet effective solutions to ensure peace of mind for you and your family. Let's delve into the world of USA Max Life Insurance and explore how their offerings can help you build a secure future.

Understanding the Basics: USA Max Life Insurance operates on the principle of providing financial protection to individuals and families in the event of unforeseen circumstances. By paying a regular premium, policyholders gain access to a wide array of benefits designed to meet their specific needs.

Term Life Insurance: Term life insurance is a popular option offered by USA Max Life Insurance. It provides coverage for a specified period, such as 10, 20, or 30 years. If the policyholder passes away during the term, the insurance company pays a death benefit to the designated beneficiaries. This benefit can help cover outstanding debts, mortgage payments, educational expenses, and daily living costs, ensuring that your loved ones are financially secure even when you're not around.

Whole Life Insurance: For those seeking lifelong coverage, USA Max Life Insurance also offers whole life insurance. This policy provides coverage for your entire life, as long as premiums are paid. In addition to the death benefit, whole life insurance accumulates a cash value over time, which policyholders can access for emergencies, education expenses, or even as a retirement supplement.

Universal Life Insurance: USA Max Life Insurance goes a step further by offering universal life insurance, which combines the benefits of life insurance with an investment component. With this policy, you can adjust your premium payments and death benefits over time to align with your evolving financial circumstances. The investment portion of the policy grows tax-deferred, allowing you to build cash value that can be used for various purposes, including supplementing retirement income or leaving a financial legacy for your loved ones.

Flexible and Customizable: USA Max Life Insurance understands that each individual's needs are unique. Therefore, they offer flexible policies that can be tailored to your specific requirements. Whether you need a basic term policy or a comprehensive coverage plan, their insurance experts will guide you through the available options to ensure you choose the policy that best fits your needs and budget.

Ease of Application and Claims Process: Applying for a USA Max Life Insurance policy is a straightforward process. The company provides user-friendly online tools and knowledgeable customer service representatives who can assist you at every step. In the unfortunate event of a claim, USA Max Life Insurance strives to make the process as seamless as possible, ensuring that your beneficiaries receive the financial support they need during challenging times.

Customer-Centric Approach: USA Max Life Insurance takes pride in its customer-centric approach, putting the policyholders' needs at the forefront. They understand that insurance can be complex and overwhelming, especially for those who are new to the world of financial planning. That's why they have a dedicated team of insurance professionals who are ready to answer your questions, explain policy details, and guide you towards making informed decisions. They prioritize transparency and ensure that you fully understand the terms, benefits, and coverage options before finalizing your policy. USA Max Life Insurance is committed to building long-term relationships with their customers, providing ongoing support and assistance throughout your insurance journey.

Added Benefits and Riders: In addition to their core insurance policies, USA Max Life Insurance offers various optional riders and additional benefits to enhance your coverage. These riders provide additional layers of protection and can be customized to meet your specific needs. Some common riders include critical illness coverage, accidental death benefit, disability income rider, and waiver of premium. By adding these riders to your policy, you can address specific concerns and ensure comprehensive protection for you and your loved ones.

Financial Planning and Education: USA Max Life Insurance understands that insurance is just one aspect of a comprehensive financial plan. They offer resources and educational materials to help policyholders make informed decisions about their financial well-being. Whether it's understanding the importance of retirement planning, managing debt, or building an emergency fund, USA Max Life Insurance strives to empower individuals with the knowledge and tools necessary to achieve financial stability.

Enhanced Customer Experience: USA Max Life Insurance is dedicated to providing an enhanced customer experience at every touchpoint. They prioritize convenience and accessibility by offering user-friendly online portals and mobile applications, allowing you to manage your policy, make premium payments, and access important documents with ease. Their responsive customer service team is available to address any queries or concerns promptly, ensuring that you receive personalized assistance whenever you need it. With USA Max Life Insurance, you can expect a seamless and hassle-free experience throughout your insurance journey.

Community Involvement and Social Responsibility: USA Max Life Insurance believes in giving back to the community and making a positive impact. They actively engage in various social responsibility initiatives and support causes that aim to improve the lives of individuals and families. From educational programs to health awareness campaigns, USA Max Life Insurance strives to create a better future for communities across the country. By choosing their services, you contribute to these noble endeavors, knowing that your insurance provider is committed to making a difference beyond financial protection.

Trusted and Reliable: With a strong presence in the insurance industry, USA Max Life Insurance has earned a reputation for being a trusted and reliable provider. They are committed to upholding the highest standards of integrity and professionalism in all aspects of their operations. As a policyholder, you can have peace of mind knowing that your insurance needs are in the hands of a reputable company with a proven track record of delivering on their promises.

Flexible Premium Options: USA Max Life Insurance understands that financial circumstances can change over time. To accommodate these changes, they offer flexible premium options. Whether you prefer a level premium that remains consistent throughout the policy term or a graded premium that gradually increases over time, USA Max Life Insurance provides choices to suit your budget and long-term financial goals. This flexibility ensures that you can maintain your coverage without straining your finances.

Additional Services and Tools: USA Max Life Insurance goes beyond traditional insurance offerings by providing additional services and tools to help policyholders make informed financial decisions. They offer resources such as financial calculators, retirement planning guides, and educational materials to empower individuals to take control of their financial well-being. These tools enable you to assess your current financial situation, set goals, and create a roadmap for achieving financial security.

Policy Reviews and Updates: USA Max Life Insurance recognizes that life circumstances can change, and your insurance needs may evolve accordingly. They offer regular policy reviews to ensure that your coverage remains aligned with your changing circumstances. This proactive approach allows you to make any necessary updates or adjustments to your policy, ensuring that it continues to meet your specific needs and offers the optimal level of protection.

Claims Assistance and Support: In times of crisis, USA Max Life Insurance stands by your side, providing prompt and compassionate claims assistance. Their claims process is designed to be streamlined and hassle-free, helping you navigate through the necessary steps with ease. The dedicated claims team is available to guide you through the process, answer your questions, and provide the support you need during difficult times. USA Max Life Insurance strives to settle claims efficiently, ensuring that your beneficiaries receive the financial support they deserve when it matters the most.

Max Life Insurance USA refers to the presence and operations of Max Life Insurance within the United States. It signifies that Max Life Insurance offers its insurance products and services specifically tailored for individuals and families residing in the USA.

Max Life Insurance plans in the USA encompass the various insurance policies offered by Max Life Insurance. These plans may include term life insurance, whole life insurance, universal life insurance, and other specialized insurance options designed to meet the unique needs of individuals in the USA.

A Max Life Insurance policy in the USA refers to the contractual agreement between the policyholder and Max Life Insurance. It outlines the terms, conditions, and benefits provided by the insurance company. The policy specifies the coverage details, premium payment obligations, and the circumstances under which the policyholder or their beneficiaries can make claims to receive financial benefits.

Max Life Insurance coverage in the USA refers to the range of risks and events that are included in the insurance policy. It outlines the specific situations or events for which the policyholder or their beneficiaries can seek financial protection and support from Max Life Insurance. Coverage may include death benefits, critical illness benefits, maturity benefits, and other applicable provisions as per the policy type.

Max Life Insurance benefits in the USA refer to the advantages and financial support provided by Max Life Insurance to policyholders and their beneficiaries. These benefits may include a lump-sum payout in the event of the policyholder's death, maturity benefits upon policy completion, tax advantages, optional riders for additional coverage, and other policy-specific advantages.

Max Life Insurance reviews in the USA pertain to the feedback, opinions, and evaluations shared by individuals who have had experiences with Max Life Insurance. Reviews can provide insights into the quality of services, customer satisfaction, claims processing efficiency, and overall performance of Max Life Insurance in the USA market. They can assist potential customers in making informed decisions regarding their insurance needs.

Max Life Insurance premium in the USA refers to the regular payments made by the policyholder to maintain their insurance coverage. The premium amount is determined by various factors, including the type of policy, coverage amount, age, health condition, and other risk factors. The premium payment is typically made monthly, quarterly, semi-annually, or annually, as per the terms of the policy.

Max Life Insurance: Max Life Insurance is the name of the insurance company. They provide life insurance coverage and related services to individuals and families.

Max Life Insurance plans: These refer to the different types of life insurance policies offered by Max Life Insurance. These plans may include term life insurance, whole life insurance, unit-linked insurance plans (ULIPs), retirement plans, child plans, and more. Each plan has specific features, benefits, and coverage options designed to meet various financial goals and protection needs.

Max Life Insurance policy: A Max Life Insurance policy is a legal contract between the insured individual and the insurance company. It outlines the terms and conditions of the coverage, including the sum assured (the amount paid out in case of a covered event), the policy duration, premium payment frequency, and any additional benefits or riders included in the policy.

Max Life Insurance coverage: Coverage refers to the extent of protection provided by a life insurance policy. Max Life Insurance coverage refers to the risks and events for which the policyholder is insured. This may include death benefits, accidental death benefits, critical illness coverage, disability coverage, and more, depending on the specific policy purchased.

Max Life Insurance benefits: Benefits are the financial advantages provided by Max Life Insurance policies. These benefits vary based on the policy type and may include a lump-sum payout to the beneficiaries upon the death of the insured, maturity benefits if the policyholder survives the policy term, tax benefits, and optional riders that offer additional coverage options.

Max Life Insurance reviews: Reviews are feedback and opinions shared by customers and policyholders about their experiences with Max Life Insurance. Reviews may cover various aspects such as customer service, claims settlement process, policy features, premium affordability, and overall satisfaction with the company. Reading reviews can help potential customers assess the reputation and reliability of Max Life Insurance.

Max Life Insurance premium: The premium is the amount policyholders pay to the insurance company to maintain their coverage. Max Life Insurance premium refers to the regular payments made by policyholders to keep their life insurance policies active. The premium amount is determined based on factors such as the insured person's age, health condition, coverage amount, policy duration, and any additional riders or benefits chosen.

Read More:

Max Life Smart Wealth Income Plan: This is an insurance-cum-investment plan offered by Max Life Insurance. It is designed to provide regular income and wealth accumulation over a specified period. The plan offers life insurance coverage along with potential returns on investment to help individuals achieve their financial goals while protecting their loved ones.

Max Life Smart Wealth Long Term Plan: This plan is a unit-linked insurance plan (ULIP) that offers long-term investment and insurance benefits. It allows individuals to invest in market-linked funds while providing life insurance coverage. The plan aims to help policyholders create wealth over the long term and meet their financial objectives.

Max Life Insurance Fixed Deposit Plan: Max Life Insurance does not offer a specific fixed deposit plan. However, they provide various life insurance plans that offer protection, savings, and investment components to cater to different financial needs.

Max Life Insurance Money Back Plan: The Max Life Insurance Money Back Plan is a traditional life insurance plan that provides periodic payouts during the policy term. It offers survival benefits at specific intervals while also providing a life insurance cover. The plan helps individuals fulfill financial obligations and enjoy liquidity through regular payouts.

Max Smart Wealth Income Plan: This is the same as the Max Life Smart Wealth Income Plan mentioned earlier, which combines insurance and investment components to provide regular income and wealth accumulation.

Max Life Insurance All Plans: Max Life Insurance offers a range of insurance plans covering various needs such as term insurance, whole life insurance, ULIPs, endowment plans, money back plans, retirement plans, child plans, and more. These plans cater to different financial goals and offer different features and benefits.

Guaranteed Lifetime Income Plan Max Life: Max Life Insurance does offer a guaranteed lifetime income plan known as the Max Life Guaranteed Lifetime Income Plan. It is designed to provide a regular income stream throughout the policyholder's lifetime, ensuring financial security and stability during retirement.

Max Life Money Back Plan: This refers to the Max Life Insurance Money Back Plan mentioned earlier, which provides periodic payouts during the policy term, combining insurance coverage with liquidity needs.

Max Life Insurance ULIP Plan: ULIP stands for Unit-Linked Insurance Plan. Max Life Insurance offers ULIPs that combine insurance coverage with investment opportunities. These plans allow individuals to invest in a variety of market-linked funds while providing life insurance protection.

Max Life Insurance Endowment Plan: The Max Life Insurance Endowment Plan is a traditional life insurance policy that provides both protection and savings. It offers a lump-sum payout upon maturity or in the event of the insured's death during the policy term.

Max Life Insurance Annuity Plan: Max Life Insurance offers annuity plans that provide a regular income stream for individuals during their retirement years. An annuity plan converts a lump sum amount into a series of periodic payments, ensuring a steady income flow.

Max Life ULIP Plan Return: The return on a Max Life Insurance ULIP plan is not fixed and depends on the performance of the chosen investment funds. ULIP returns are linked to the market performance of the underlying investment funds, which can fluctuate.

Max Life Annuity Plan: This refers to the Max Life Insurance Annuity Plan mentioned earlier, which provides a regular income stream during retirement.

Max Life Insurance: Max Life Insurance is an insurance company that offers a wide range of life insurance plans and services to individuals and families. They aim to provide financial protection and help individuals achieve their long-term financial goals.

Max Life Insurance Policy Details: Policy details refer to the specific terms, conditions, and benefits of a Max Life Insurance policy. It includes information about the coverage, premium payments, policy duration, maturity benefits, death benefits, riders, and other policy-specific features.

Q: What is Max Life Insurance?

A: Max Life Insurance is an insurance company that provides various life insurance plans and services to individuals and families. They offer a range of policies designed to meet different financial goals and protection needs.

Q: What types of insurance plans does Max Life Insurance offer?

A: Max Life Insurance offers a wide range of insurance plans, including term life insurance, whole life insurance, unit-linked insurance plans (ULIPs), endowment plans, retirement plans, child plans, and more. Each plan has specific features and benefits.

Q: How can I calculate the premium for a Max Life Insurance policy?

A: You can use the premium calculator tool on the Max Life Insurance website or contact their customer service to calculate the premium for a specific policy. The premium amount is influenced by factors such as age, coverage amount, policy duration, and health condition.

Q: How can I purchase a Max Life Insurance policy?

A: You can purchase a Max Life Insurance policy by visiting their official website, contacting their customer service, or reaching out to a Max Life Insurance agent. They will guide you through the application process and provide the necessary information and forms.

Q: What is the claim settlement process for Max Life Insurance policies?

A: The claim settlement process involves notifying Max Life Insurance about the claim, submitting the required documents, and undergoing an evaluation. Once the claim is approved, the benefits are paid out to the policyholder or beneficiary as per the policy terms.

Q: Can I customize my Max Life Insurance policy with additional riders?

A: Yes, Max Life Insurance offers optional riders that can be added to your base policy for additional coverage. These riders may include critical illness riders, accidental death benefit riders, waiver of premium riders, and more. Adding riders is subject to policy terms and conditions.

Q: How can I check the status of my Max Life Insurance policy?

A: You can check the status of your Max Life Insurance policy by logging into your online account on the Max Life Insurance website or by contacting their customer service with your policy details. They will provide you with the necessary information regarding your policy status.

Q: Can I surrender my Max Life Insurance policy before the maturity date?

A: Yes, you can surrender your Max Life Insurance policy before the maturity date. However, surrendering a policy may have financial implications, such as surrender charges and loss of benefits. It is recommended to review the policy terms and consult with a Max Life Insurance representative before making a decision.

Q: What are the tax benefits associated with Max Life Insurance policies?

A: Max Life Insurance policies may offer tax benefits as per the prevailing tax laws. The premiums paid towards life insurance policies may be eligible for tax deductions under Section 80C of the Income Tax Act. The tax benefits can vary, and it is advisable to consult with a tax advisor for specific details related to your policy.

Q: How can I contact Max Life Insurance customer service?

A: You can contact Max Life Insurance customer service by calling their toll-free number, sending an email, or visiting their official website for contact information. They have dedicated customer service representatives who can assist with your queries, policy-related matters, and claims assistance.

Q: How long does it take to process a claim with Max Life Insurance?

A: The claim processing time with Max Life Insurance depends on various factors such as the type of claim, the completeness of documentation, and the complexity of the case. In most cases, Max Life Insurance strives to settle claims within a reasonable time frame, typically within 10 to 15 working days.

Q: Can I revive a lapsed Max Life Insurance policy?

A: Yes, you can revive a lapsed Max Life Insurance policy under certain conditions. The revival process involves paying the outstanding premiums along with any applicable penalties or charges. The feasibility of revival depends on the policy terms and the duration since the policy lapsed. It is recommended to contact Max Life Insurance customer service for specific details and guidance.

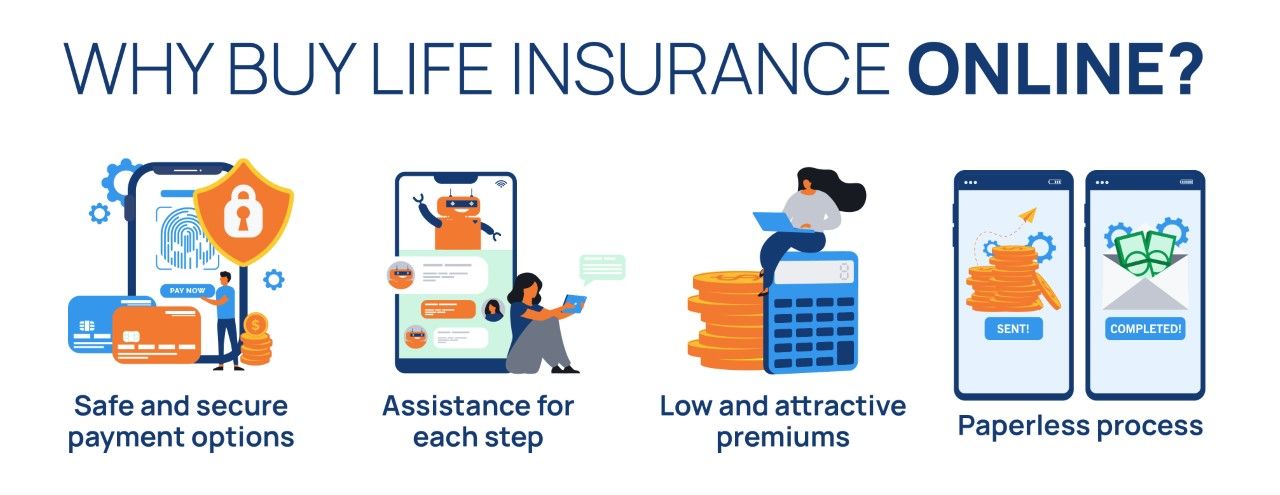

Q: Does Max Life Insurance offer online premium payment options?

A: Yes, Max Life Insurance provides convenient online premium payment options through their official website. Policyholders can log in to their accounts, navigate to the premium payment section, and choose the desired online payment method such as net banking, debit card, or credit card to pay their premiums securely.

Q: What happens if I miss a premium payment for my Max Life Insurance policy?

A: If you miss a premium payment for your Max Life Insurance policy, it may result in a grace period during which you can make the payment without any penalties. The grace period is typically 30 days, but it may vary based on the policy terms. If the premium remains unpaid beyond the grace period, the policy may lapse, and the coverage may cease. It is advisable to contact Max Life Insurance customer service to understand the options available in such situations.

Q: Can I change the nominee for my Max Life Insurance policy?

A: Yes, you can change the nominee for your Max Life Insurance policy. Most policies allow you to update the nominee details by submitting a written request along with the necessary documents to Max Life Insurance. It is important to keep your nominee information up to date to ensure a smooth claims process.

Q: Can I transfer my Max Life Insurance policy to another person?

A: No, you cannot transfer a Max Life Insurance policy to another person. Life insurance policies are non-transferable and are meant to provide financial protection for the policyholder and their beneficiaries.

Q: Does Max Life Insurance offer any online services for policyholders?

A: Yes, Max Life Insurance offers various online services for policyholders, including online premium payment, policy renewal, accessing policy documents, checking policy details, and updating personal information. These services can be conveniently accessed through the Max Life Insurance website or mobile application.

Q: Can I apply for a Max Life Insurance policy online?

A: Yes, Max Life Insurance provides an online application facility for certain insurance plans. Interested individuals can visit the Max Life Insurance website, select the desired plan, and follow the online application process. However, not all policies may be available for online purchase, and it is advisable to check the specific details on the website or contact Max Life Insurance for assistance.